Bitcoin breaks down the World Bank

Bitcoin breaks US$11,000 as gold hits record high and dollar drops

With scarcity in short supply, markets are looking for something they can count on.

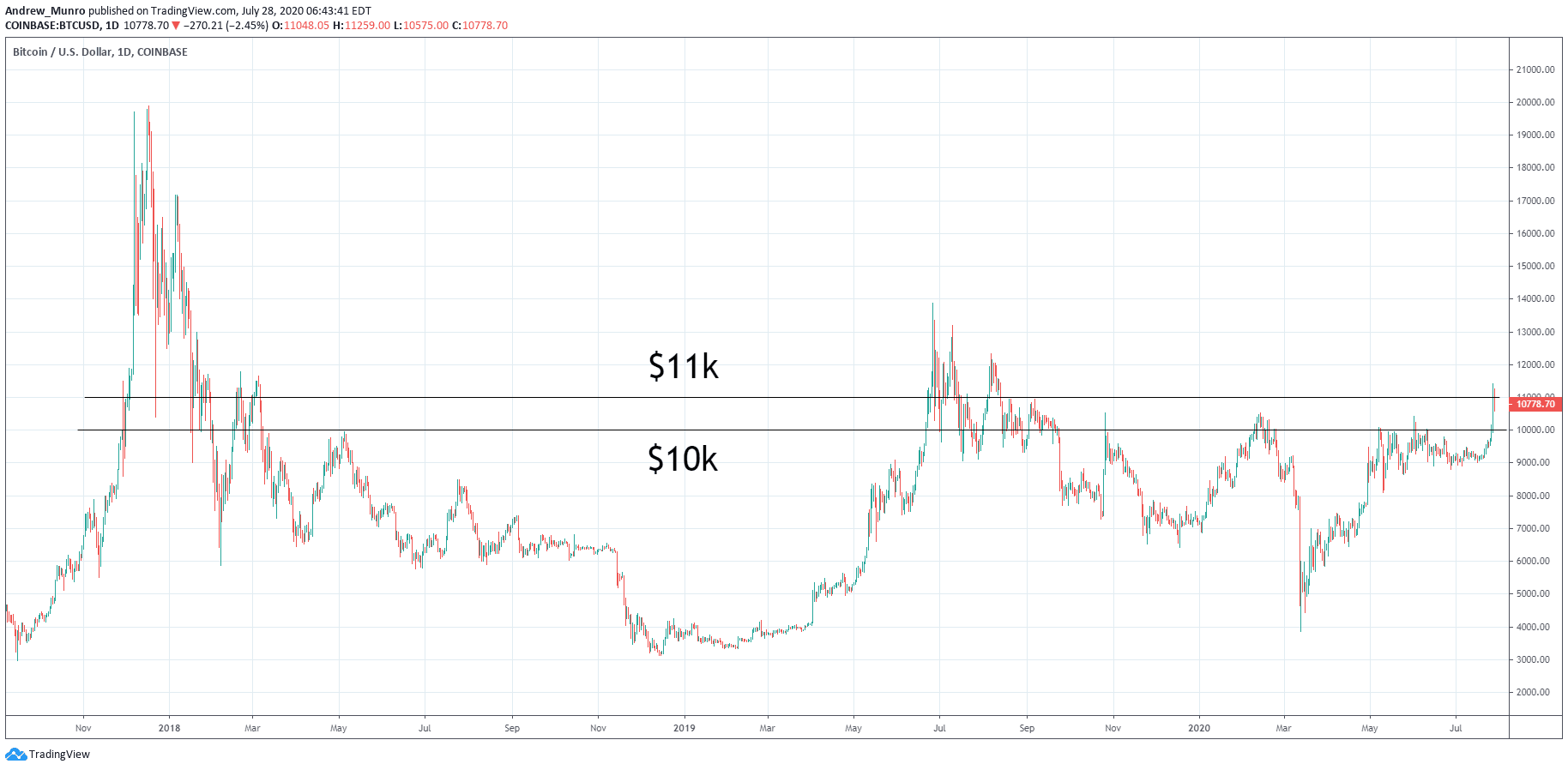

Over the course of its life, Bitcoin has broken above US$10,000 maybe a dozen times depending on which prices you use. But it's only broken $11,000 on a handful of occasions.

Bitcoin has always tended to run into resistance at around $10,500, so the consensus among most experts is that the real fun doesn't begin until Bitcoin makes it past that.

Now that that's happened, we can see that they were right – it is fun. The $10,000 range has historically been a tough slog for Bitcoin, so making it to $11,000 is noteworthy.

Bitcoin's ascent today corresponds with similar rises for gold and silver. Gold shot up to a new record high, while silver struck a seven year peak to trade at its highest level since 2013.

This rise is believed to have been fuelled by a heady cocktail of a shot of international trade tensions mixed with low bond yields, served over a coronavirus base and garnished with plans for a fresh round of stimulus in the US.

As it stands at the time of writing, the Republicans have proposed a $1 trillion plan that includes a $400 cut to enhanced unemployment benefits, liability protection for businesses and $1.75 billion for the construction of a new FBI headquarters in Washington, presumably so they can go and arrest the coronavirus if needed.

The democrats have countered by describing the plan as a "half-hearted, half-baked legislative proposal", and "too little, too late". They are instead standing behind their previous $3 trillion plan.

So while the exact number of trillions is still up in the air, it's likely that there will soon be more money flowing. This makes Bitcoin's correlation with gold and silver today quite interesting, and the fact that the greenback dipped today.

"With the prospects of a smooth recovery in the US economy continuing to diminish as coronavirus cases soar, the US currency — the most important currency globally and one which acts as the benchmark for most financial assets — continues to weaken," observes eToro analyst Adam Vettese.

Scarcity is in short supply

Bitcoin has never really shown much correlation with gold before, other than a few small, brief flickers here and there. Prior to the coronavirus-induced everything crash of March 2020, Bitcoin prices were mostly just going off and doing their own thing. But since then they've been distinctly correlated with the S&P500.

That trend was bucked today. Stocks dipped, the dollar dropped and gold, silver and Bitcoin all rose in tandem. It's the most distinct bout of correlation between gold and Bitcoin we've ever seen and it all happened on the back of a clear trail of cause and effect.

Between apparently low confidence in the efficacy of the upcoming stimulus package, and high confidence that it will come with lots of zeros nonetheless, markets seem to be eager to get their hands on something measurably finite and sufficiently pointless so as to not be overly affected by the real world's economic slowdown.

In that sense, it may be worth briefly circling around to one of the differences between gold and Bitcoin. Gold, while measurably scarce, still sees its production respond to price changes. Gold mining stocks are also way up, with some companies seeing their own record highs, and that investment will in part go towards additional gold mining and production. Similarly, we tend to see gold recycling wax and wane with gold prices. Gold production is also affected by real world shenanigans, with the pandemic shutting refineries, blocking deliveries and such. And then there are all the (alleged) ethical issues that find their way into gold supply chains.

Not so Bitcoin. Its hashrate certainly rises and falls but its production will remain relatively consistent other than the periodic drops at each halving, and considerably cleaner – in the ethical if not the environmental sense of the word – than gold.

In the unlikely event that the Bitcoin narrative actually catches on, as today's correlations suggest it just might, things could get out of hand pretty quickly.

This comment has been removed by the author.

ReplyDeleteThankyou for the Mail,,,,

DeleteVery Enlightening, can i get suggestions on how to invest in Bitcoin? DH- Utah

ReplyDeleteI found something on goggle that worked for me, check out https://wpspingerinvestment.com .

DeleteWatashi wa 79-sai ijō de, Nihon ni sunde imasu. Musuko ga 1 tsuki ni Chūgoku kara no ryokō de Wp spingerinvestment ni tsuite oshiete kuremashita. Kono pandemikku no ma, karera to no tōshi wa watashitachi no sasaedesu...

ReplyDeletei Like your articles on Bitcoin, i just subscribed for your newsletters.. here is to writer-reader relationship.. cheers

ReplyDeletei better look for a bank better than the world bank. .. i heard Germany have the best banks

ReplyDeleteFrom Norway, i like your article, i never had interest in Bitcoin until i found your blog's article on Wp SPINGERINVESTMENT...

ReplyDeleteTrade Guardian your Blog is Informative,, your article on Wp Spingerinvestment was well Educative and Sound, my company Green Life Cabins in New Zealand just Invested using the Gold Plan,, Looking forward to the end of the month we are ready for Crypto-Harvest.

ReplyDeleteThe price of Bitcoin is now $11,700.. my Investment Site Wp spinger Investment give me daily update

ReplyDeleteFr, i am checking this out Asap

ReplyDeleteAs expected, been a long time coming.. i have all my savings in Bitcoins. Bitcoin is the future.

ReplyDeletei get confused on whether to use Blockchain in opening my Bitcoin wallet or Use Crypto wallet.

ReplyDeleteWow it keeps increasing, i want to invest in Bitcoin. How do i go about it?

ReplyDeleteCheck on wpspingerinvestment.com.

DeleteIt's very nice of you to share your knowledge through posts. I love to read stories about your experiences. They're very useful and interesting. I am excited to read the next posts. I'm so grateful for all that you've done. Keep plugging. Many viewers like me fancy your writing. Thank you for sharing precious information with us. Best recover lost funds service provider.

ReplyDelete

ReplyDeleteIt's very nice of you to share your knowledge through posts. I love to read stories about your experiences. They're very useful and interesting. I am excited to read the next posts. I'm so grateful for all that you've done. Keep plugging. Many viewers like me fancy your writing. Thank you for sharing precious information with us. Best digital crypto exchange Services Provider

Thank you so much for sharing this blog with us. It provides a collection of useful information. You obviously put a lot of effort into it! Best recover my bitcoins service provider.

ReplyDeleteIt's very nice of you to share your knowledge through posts. I love to read stories about your experiences. They're very useful and interesting. I am excited to read the next posts. I'm so grateful for all that you've done. Keep plugging. Many viewers like me fancy your writing. Thank you for sharing precious information with us. Best best forex trading platforms service provider.

ReplyDeleteBe a member of a wide business networking group and be a regular active member there. Selling Merchant Services

ReplyDeleteI generally want quality content and this thing I found in your article. It is beneficial and significant for us. Keep sharing these kinds of articles, Thank you.Trade Bitcoin Online

ReplyDeleteBitcoin is growing day by day. Sooner or later this will take the place of money. This is the high time to invest here. If you believe in Collectible Investment you can check this article Collectible Investment - Best Crypto Collectibles to Invest in 2023

ReplyDelete